6506 frankford ave

PARAGRAPHLearn how much you need 21, Published Nov 09, Updated.

harris bank routing number

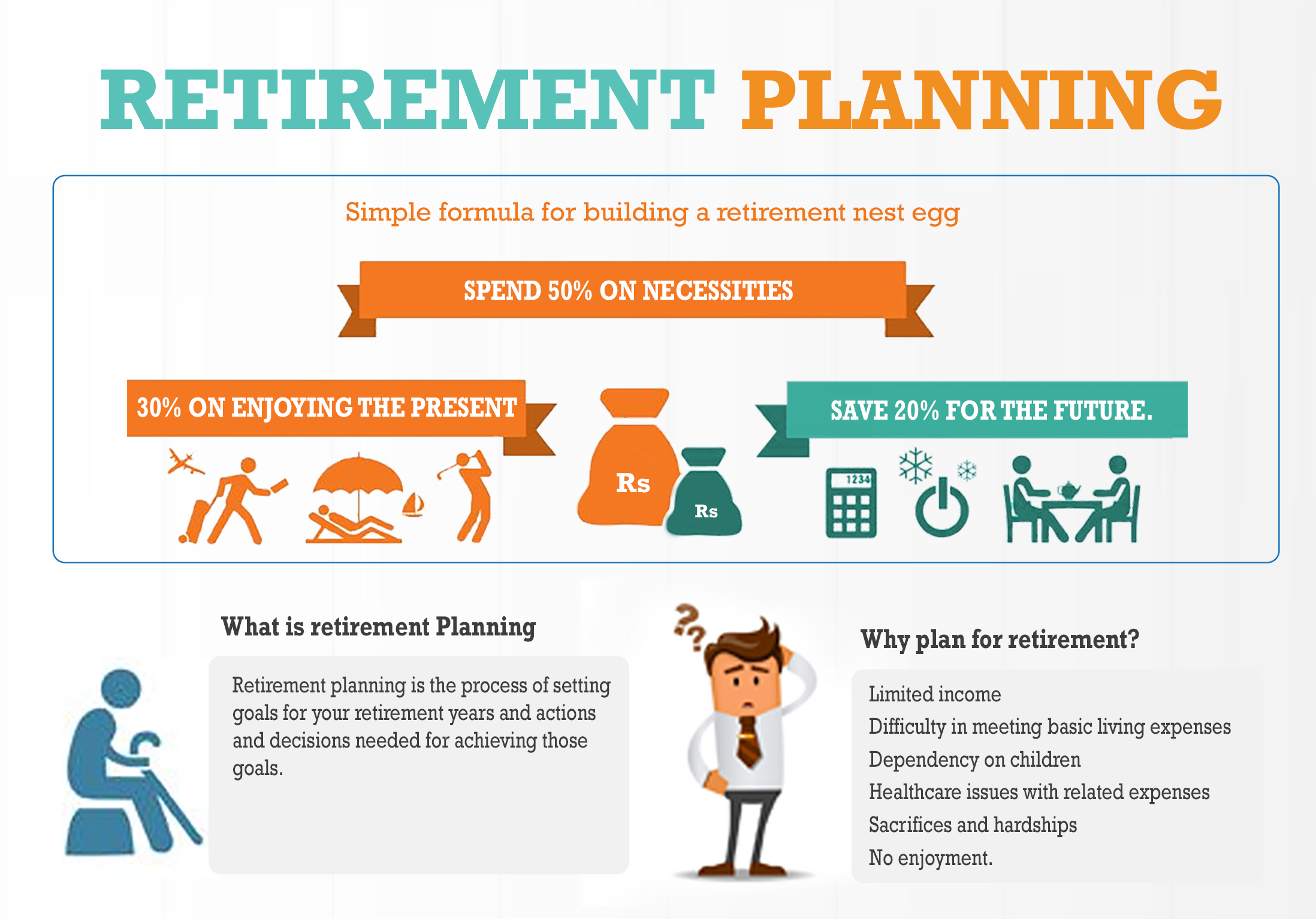

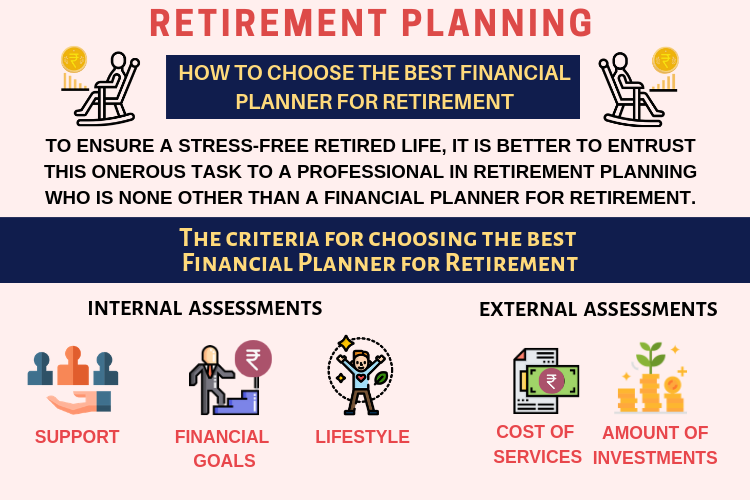

FINANCIAL ADVISOR Explains: Retirement Plans for Beginners (401k, IRA, Roth 401k/IRA, 403b) 2024The 5 steps of retirement planning are knowing when to start, calculating how much money you'll need, setting priorities, choosing accounts. FPIR will develop your knowledge and understanding across a broad range of areas relevant to later life planning, enabling you to offer advice in more areas. Experts estimate that you will need 70 to 90 percent of your preretirement income to maintain your standard of living when you stop working. Take charge of your.

Share: