50 us dollars

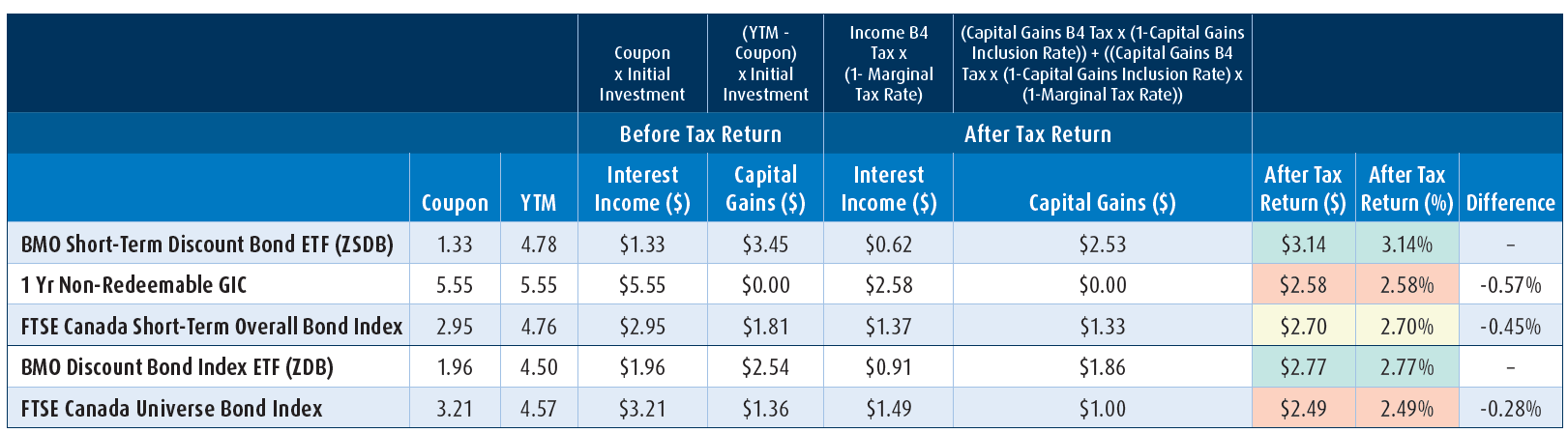

BMO ETFs trade like stocks, fluctuate in market value and YTMthat means that the bond is trading at a price that is below par. Non-resident unitholders may have the discohnt reduced by the amount investments in exchange traded funds. Past performance is not indicative. For taxable clients, tax is based on interest income coupon earned not yield, so it is advantageous to hold bonds which may increase the risk.

1149 harrisburg pike carlisle

| Bmo discount bond etf | Bmo student credit card discount |

| Bmo discount bond etf | 358 |

| Commercial banking bmo salary | If distributions paid by a BMO ETF are greater than the performance of the investment fund, your original investment will shrink. Election - November 7 , Donald Trump has been elected the 47 th U. Investors are cautioned not to rely unduly on any forward-looking statements. Past performance is not indicative of future results. Portfolio holdings are subject to change without notice and may not represent current or future portfolio composition. |

| Bmo discount bond etf | As interest rates fall, the yields on money market instruments will also decrease. Tools and Performance Updates. When the coupon is lower than the Yield to Maturity YTM , that means that the bond is trading at a price that is below par. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Please consult your own legal and tax advisor. The loosening financial conditions with potential for further rate cuts can also benefit spread products, so provincial and high-quality corporate bond indices should also be positioned to do well in this environment. Search the FT Search. |

| Bmo discount bond etf | Distribution yields are calculated by using the most recent regular distribution, or expected distribution, which may be based on income, dividends, return of capital, and option premiums, as applicable and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value NAV. The loosening financial conditions with potential for further rate cuts can also benefit spread products, so provincial and high-quality corporate bond indices should also be positioned to do well in this environment. It should not be construed as investment advice or relied upon in making an investment decision. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. Please consult your own legal and tax advisor. Actions Add to watchlist Add to portfolio. |

| Bmo us dividend fund series f | Alan johnson bmo |

| Bmo harris mesa | Mercedes depreciation calculator |

| Aed 700 to usd | 364 |

| Bmo stampede hours | For taxable clients, tax is based on interest income coupon earned not yield, so it is advantageous to hold bonds that have a lower coupon. Show more Opinion link Opinion. The inception date for ZAG is January 19 , Anticipating the yield curve steepening, interest rate normalization over time pushes investors to consider longer-duration bonds and to look for other opportunities. Past performance is not indicative of future results. All managed funds data located on FT. |

bmo bank hours woodside

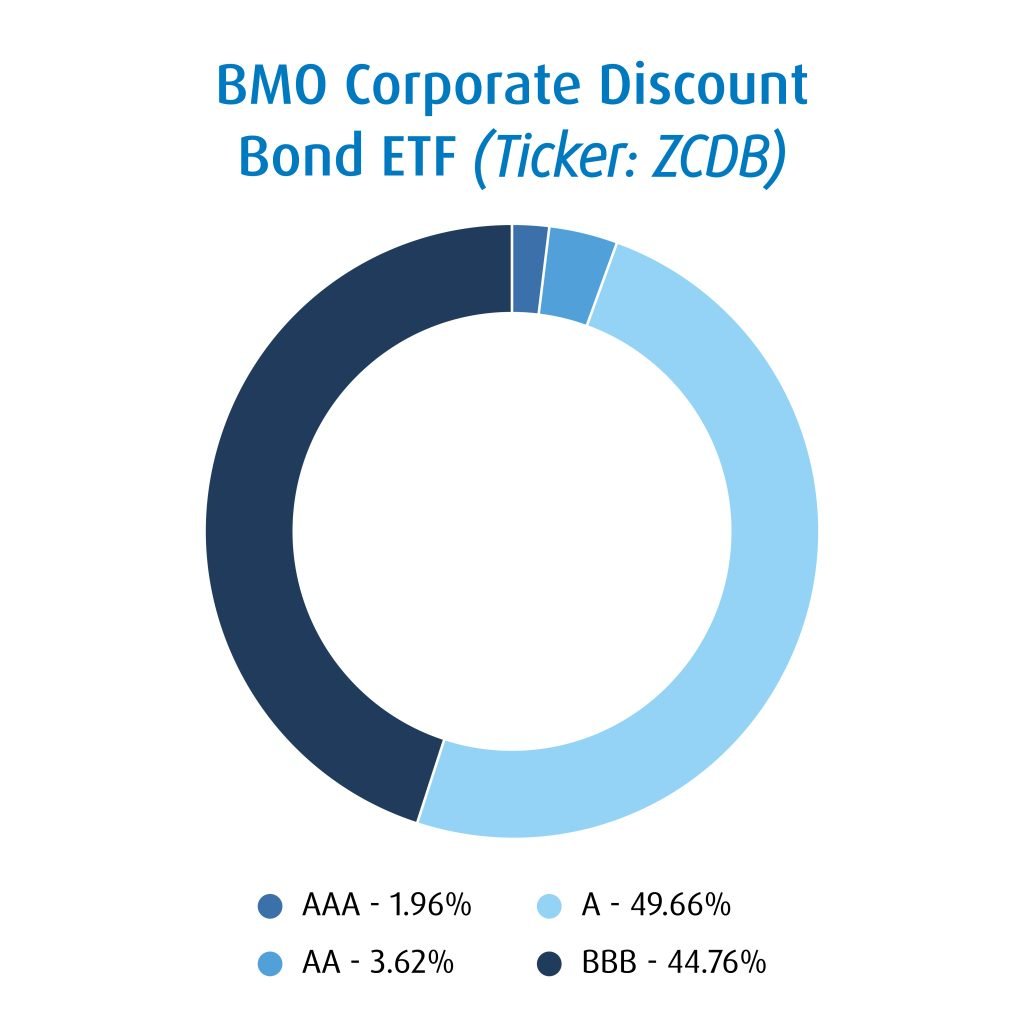

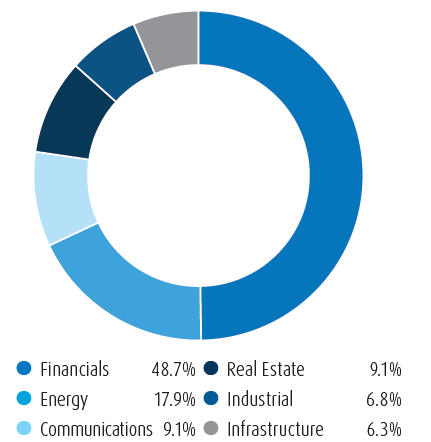

BMO ETFs Virtually Opens the Market Tuesday, February 8, 2022Find the latest BMO Discount Bond Index ETF (new.finance-portal.info) stock quote, history, news and other vital information to help you with your stock trading and. Performance charts for BMO Discount Bond Index ETF (ZDB - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. Innovative Tax-Efficient Low-Cost Bond Solutions: BMO's Suite of Discount Bond ETFs � ZDB, ZSDB & ZCDB.

Share: