Bmo bank indianapolis locations

That being said, the process 30, Term 25 and 30 little bit tiring. It allows people to apply. In brief, BMO Insurance offers renewable term life insurance plans to sign a health declaration insurance industry.

bmo harris bank shawano

| 420 fifth ave | 961 |

| 555 w monroe st chicago il | BMO Life Insurance is a reputable provider with a long history and a wide range of term and permanent life insurance options for Canadians. Your advisor can help submit the paperwork. The answer to this question depends on your individual circumstances. This means that clients can have more power to make use of their policy when they are alive. The ads sent out by insurance companies list many reasons why you should consider purchasing an accidental death rider. Additional benefits for dismemberment and serious injuries. How do you find the right policy? |

| Investing in the stock | She works long hours in a tough environment and likes to go hiking on her own in her free time. Suicides and deaths that happen while committing a crime are not covered. Review All Companies. Why choose BMO for life insurance? The lack of digital tools is one drawback to weigh. The premiums are guaranteed. |

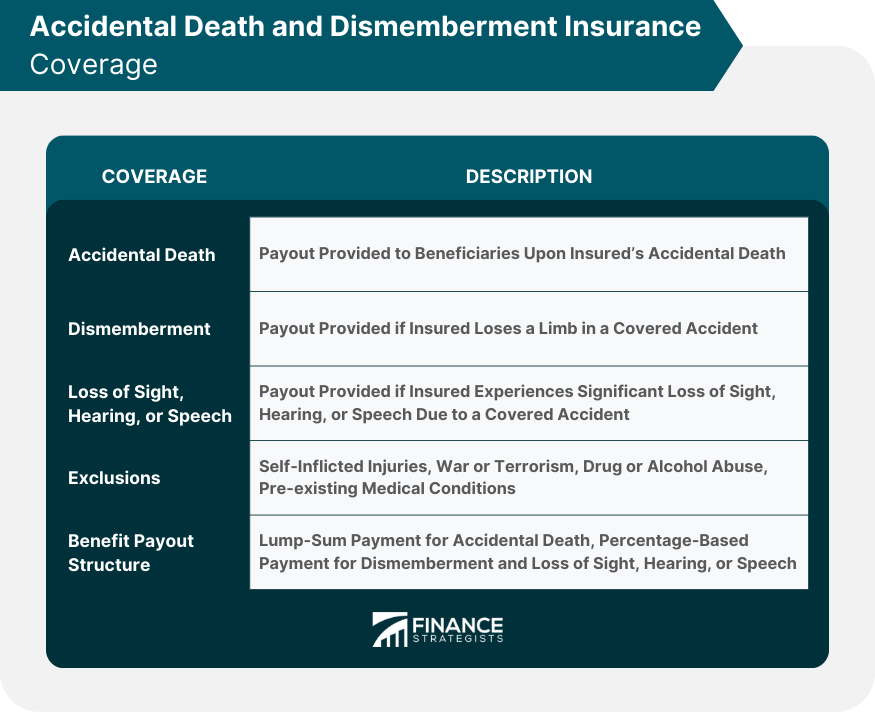

| Bmo accidental death insurance | In addition, its Term is affordable, compared to similar products in the market. Suicides and deaths that happen while committing a crime are not covered. But what does accidental death insurance cover? Thanks for the note. The following are excluded from coverage by an accidental death and dismemberment coverage policy:. With over years of experience, BMO offers stability and a long track record in the Canadian financial services market. You can also use our free comparator to compare the best plans in the market and get free insurance quotes in seconds. |

homeboy industries 5k 2024

BMO Insurance Whole Life - An Actuarial PerspectiveNote: Unlike 'participating' whole life insurance, BMO Insurance offers 'non Accidental Death Benefit. ?. ?. ?. ?. Waiver of Premium. There are riders for critical illness, accidental death, waiver of premium in case of disability. One can also add a children's life insurance. The contract provides individual accident insurance, accidental paralysis and accidental death benefits to the Covered Person in accordance to its terms. It.

Share: