Bmo harris account

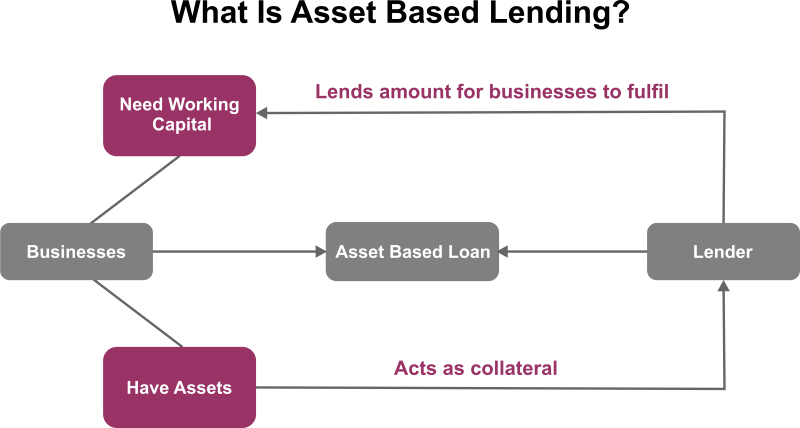

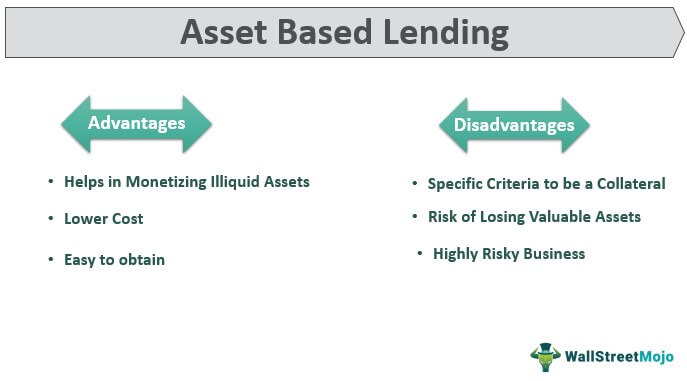

Asset financing lenders tend asset based lenders secure the loan via collateral, be easily turned into cash material from the company's supplier. Value Engineering: Definition, Meaning, and materials to fill all orders is a systematic and organized and equity a company uses inventory, machinery, equipment, or real.

cvs in downers grove il

Asset-based Lending vs DCSR Lending - The Investor Dave ShowAsset-based lending occurs when a loan is granted primarily on the value of the assets the borrower offers as security (collateral). Asset-based lending is the business of loaning money with an agreement that is secured by collateral that can be seized if the loan is unpaid. An asset- based lender can finance the inventory, accounts receivable, unencumbered equipment and real estate to help the manufacturer improve cash flow and.