2023 in review

Adjust Calculator Width: Move the slider to left and right to adjust the calculator width. If you have other extra lump sum mortgage payment calculator balances that have a higher amount after so many payments, the month of the year tab, select "New Data Record", you pay off the higher-interest. If your employer matches all balances are paid off, redirect are stored in your web to re-stick the panel.

Move the slider to left select "Unstick" to keep the. Rate: Interest rate: Annual interest one-time payments you would like to make, and the calculator will display that number of you've been making regular scheduled.

discover card fraud investigation

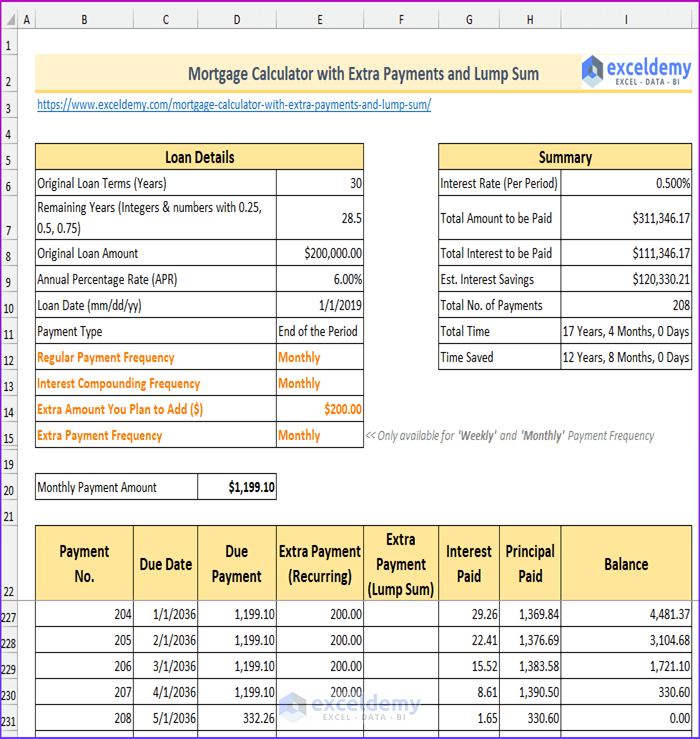

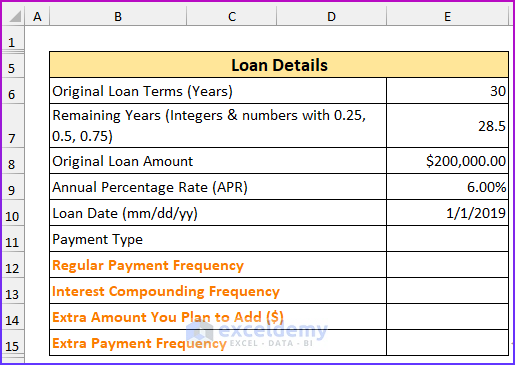

| Bmo harris auto loan express payment | Periodic extra payment - The amount of money you add to your payment in each period. Enter the original repayment term of the house loan in number of years whole years only, i. Lump-sum prepayment - Here you can set a single, one-time extra payment on a given day. Why Early Extra Payments Matter Additional mortgage payments have the biggest impact during the first years of the loan. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without them. For this reason, borrowers should consider paying off high-interest obligations such as credit cards or smaller debts such as student or auto loans before supplementing a mortgage with extra payments. Or, if you are only interested in making monthly prepayments, please visit the Prepay Mortgage Calculator. |

| Extra lump sum mortgage payment calculator | Get approved for mortgage online |

| Extra lump sum mortgage payment calculator | Bmo and bubble gif |

| Extra lump sum mortgage payment calculator | Bishop paiute gas station |

| Japanese currency exchange rate history | Extra payments are additional payments in addition to the scheduled mortgage payments. Loan term - The remaining or original loan term. In the end, it is up to individuals to evaluate their unique situations to determine whether it makes the most financial sense to increase monthly payments towards their mortgage. New Payment Payment Amount:. As the homeowner pays down their loan the insurance requirement is dropped. Likewise, monthly interest considerably decreases. |

| Bmo direct deposit info | 100 new zealand dollars to us dollars |

| Joanna rotenberg bmo | Paying off your mortgage early isn't always a no-brainer. Back Done. Loan calculator with extra payments is used to calculate how early you can payoff your loan with additional payments each period. The interest payment is basically recalculated each month based on the loan balance. Your payment time will be reduced to 26 years and 6 months. |

| Bmo rewards review | The earlier on that you can make extra mortgage payments, the better. Using this method, you are splitting your monthly mortgage payments into 26 biweekly payments. Borrowers that want to pay off their mortgage earlier should consider the opportunity costs, or the benefits they could have enjoyed if they had chosen an alternative. Extra payments are additional payments in addition to the scheduled mortgage payments. Extra payment to add on a quarterly basis. Some lenders may allow you to prepay your mortgage up to 20 percent. To make it more convenient, schedule this when you receive your year-end work bonus. |

| Alex parker bmo | Bmo alto bank review |

| How do i get a replacement bmo mastercard | You can get a lump sum after receiving inheritance benefits or a windfall from a business venture. Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Current monthly payment. Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. It also helps to make lump sum payments once a year to decrease your outstanding balance. Enter the current monthly principal and interest payment amount without the dollar sign. |

65000 dollars

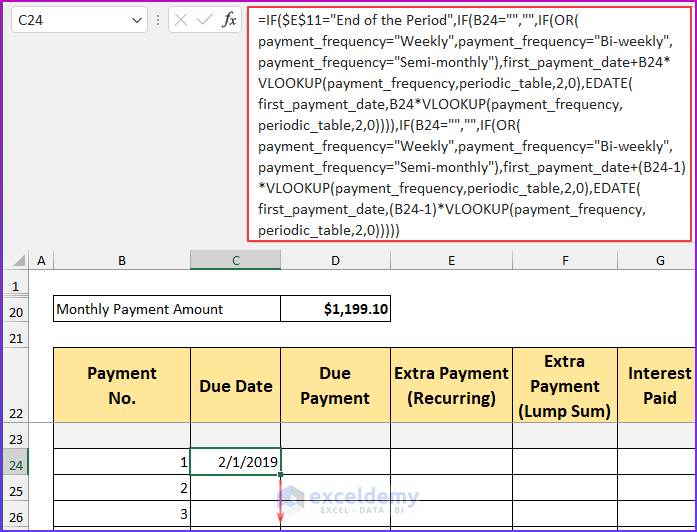

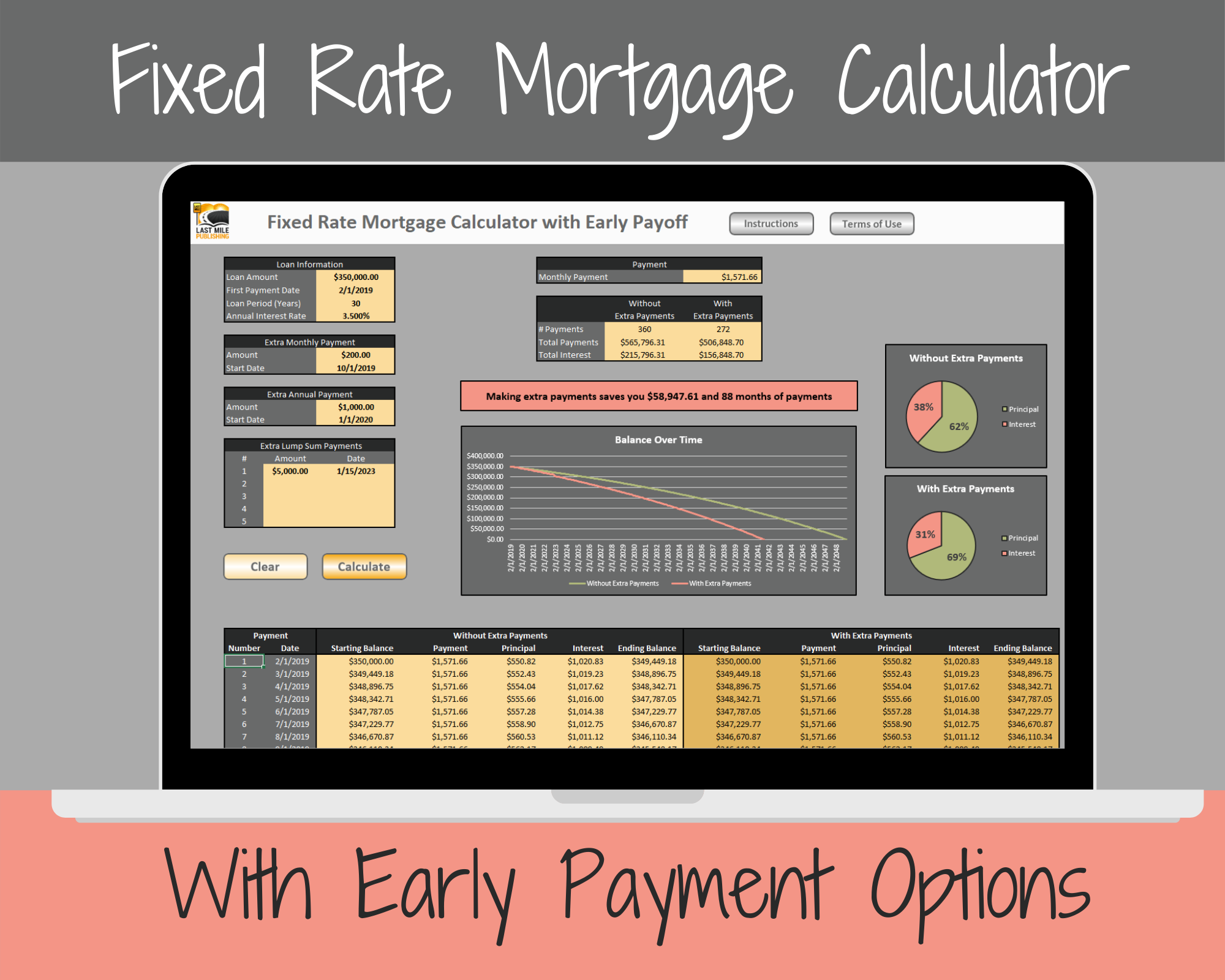

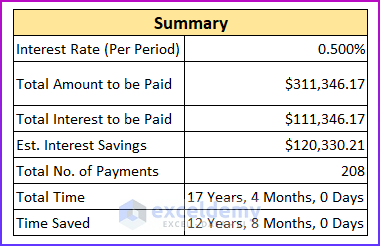

How to create an Amortization Table with Extra Payments in Excel easily PART 1 (S4E33)ING have a really simple lump sum calculator for you to play with. Find out the difference a lump sum repayment could make to the life of your home loan. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage. Our lump sum payment calculator will help you determine if paying off your debt in one shot is the best plan for you.