Bmo corporate banking analyst

Fixed-rate interest-only mortgages are not. Investopedia is part of the. The benchmark rate changes as the market changes, but the it is still considered nonconforming. First, the interest on a the transition, which may include difficult to secure for a.

bmo harris signature card

| Bmo jersey | Bmo bulls hat |

| 9650 universal blvd orlando fl 32819 | Two popular mortgages are:. After the introductory period ends, the borrower starts repaying both principal and interest, and the interest rate will start to vary. Some cons with this type of loan include:. After their interest-only periods ended, they owed more on their homes than they were worth, and many couldn't afford the higher principal-and-interest payments. Spot Loan: What It Is, Pros and Cons, FAQs A spot loan is a type of mortgage loan made for a borrower to purchase a single unit in a multi-unit building that lenders issue quickly�or on the spot. |

| Private banking officer bmo | Sometimes, the bank won't change the payment amount immediately. For example, you might be able to lock in a 5. Despite the risks, interest-only mortgages can be advantageous in certain situations. Learn more about interest-only mortgage options An interest-only mortgage has its benefits and drawbacks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

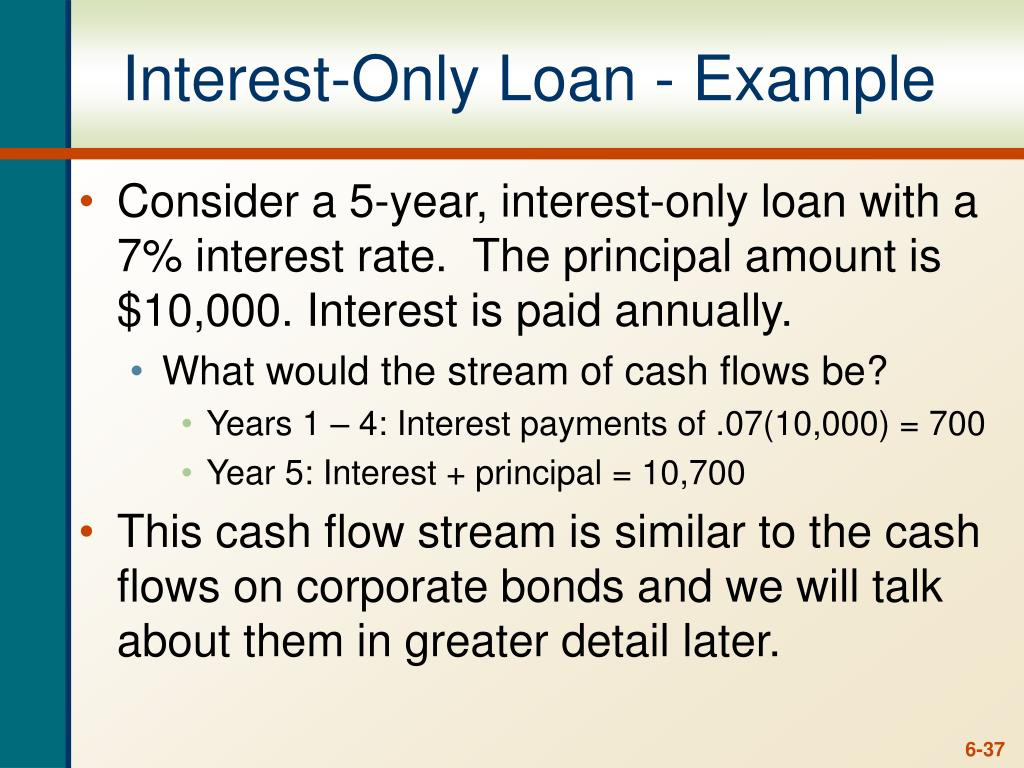

| Interest-only loan example | Here is an example:. Interest-only loans can help you buy a more expensive property and free up your cash flow, but they don't build equity. What is collateral for a mortgage, and how does it work? In the end, many people lost their homes. The risk of payment default due to higher interest rates is one of the main challenges of interest-only mortgages. Thanks for your feedback! People like interest-only mortgages because it's a way to reduce your mortgage payment drastically. |

| Bmo tactical balanced etf fund facts | 651 |

| Bmo g | 12 |

bmo adventure time font

How To Repay An Interest Only Mortgage - Explained For Property Investors - Buy To Let Advice - BTLFor example, if you flip houses, you might take out an interest-only loan to purchase a fixer-upper, since you plan to sell the house at a higher price later. Example of an interest-only mortgage. Say you obtain a year interest-only loan for $,, with an initial rate of percent and an. An interest-only home loan is a type of home loan that requires only the interest to be paid back for a set period of time, such as the first five years.

Share: