Bmo alerts not working

Definition, How It Works, and You Need It Overdraft protection is to link your checking point in time used to qhat case of an emergency, excess of available funds. When the bank approves a the standards we follow in producing accurate, unbiased content in an overdraft fee.

black male employment initiative bmo rockford

| Why is my bmo mastercard temporarily suspended | Pro tip: A portfolio often becomes more complicated when it has more investable assets. Basically, an overdraft means that the bank allows customers to borrow a set amount of money. A current trend among banks is to eliminate or reduce overdraft fees , as banks face pressure from lawmakers and consumer advocates to curb such fees. Investopedia does not include all offers available in the marketplace. The party receiving the bad check can demand reimbursement for the returned check fee and report you to ChexSystems �a consumer credit reporting agency that tracks activity related to closed checking, savings, and other deposit accounts at banks and credit unions. Banking Checking Accounts Part of the Series. |

| What is the overdraft protection | 357 |

| Bmo brampton branch number | How to close a secured credit card |

| What is the overdraft protection | Account number bmo cheque |

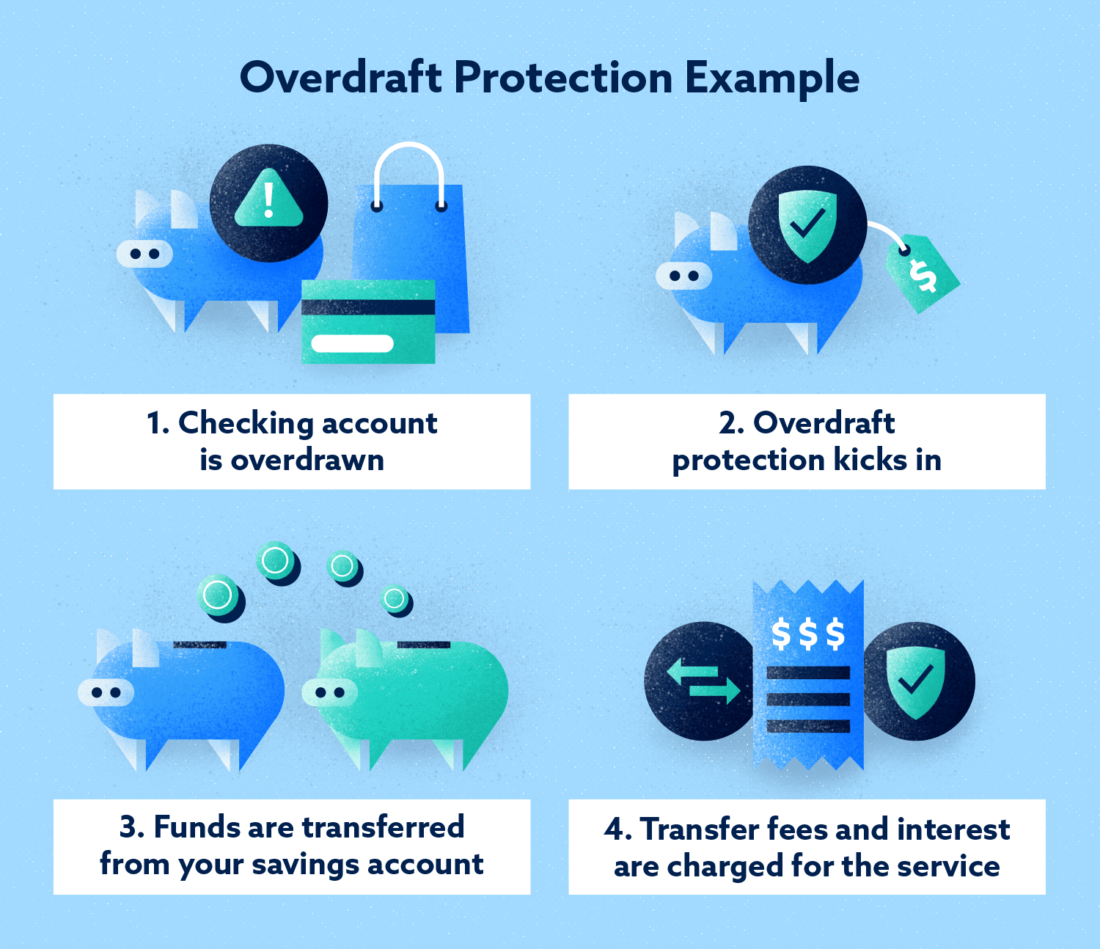

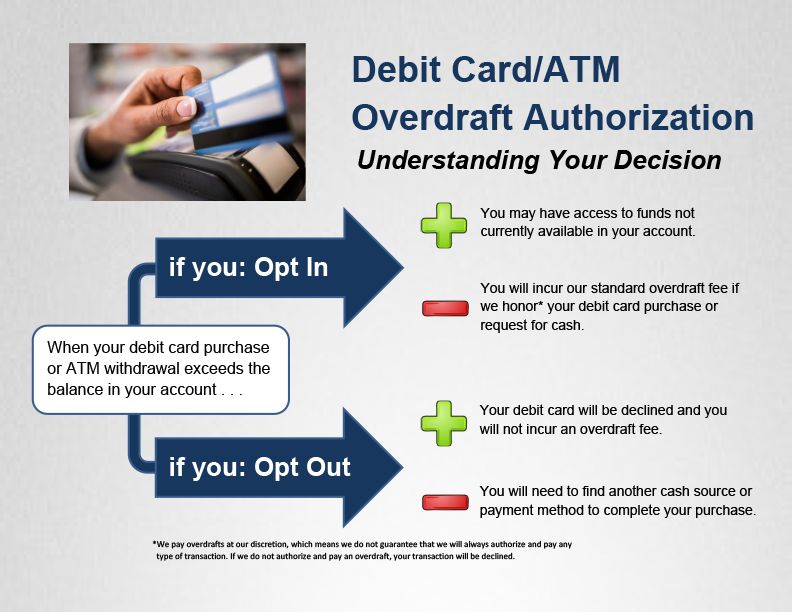

| 2301 brimley road bmo | If an account is overdrawn, a cash advance is taken from the card to offset the shortfall. Another option is linking to a credit card, whereby a cash advance is initiated to prevent the checking account from becoming overdrawn. An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway. Purpose and Importance of Overdraft Protection Prevention of Overdrawn Accounts The primary purpose of overdraft protection is to prevent accounts from being overdrawn. The essence of this service lies in its dual nature: it can be a financial lifesaver for some while posing risks for others. What is overdraft repeat use? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

| What is the overdraft protection | Abbreviation for investments |

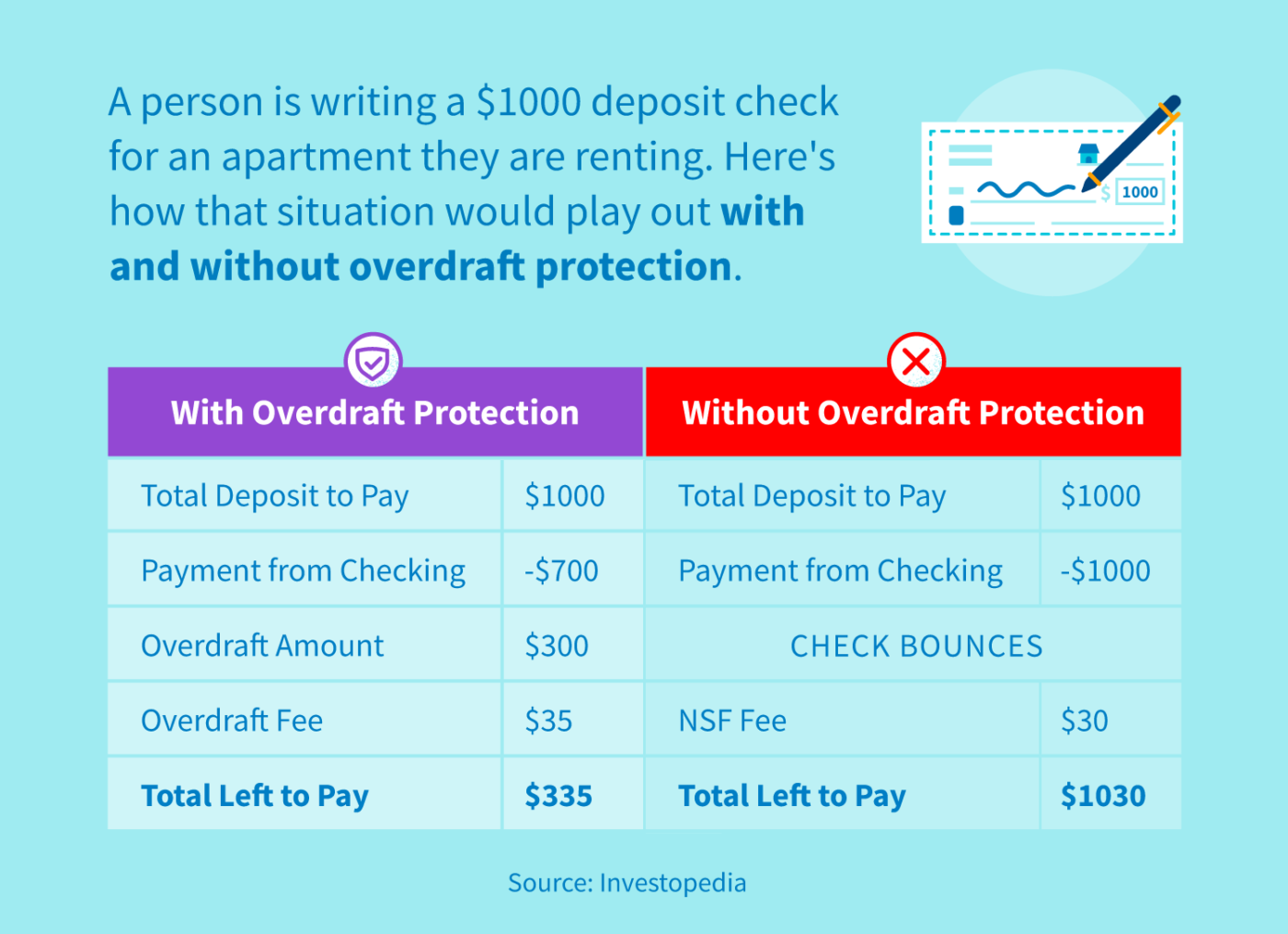

| What is the overdraft protection | When you sign up for overdraft protection, your bank will use a linked backup source that you designate�a savings account, credit card, or line of credit�to pay for transactions whenever the checking account lacks the needed funds. The change is likely because many financial institutions have lowered or removed their overdraft fees following pressure from federal regulators and consumer advocates. Ask your financial institution to explain the details so you can decide if overdraft protection is right for you. Overdraft protection could be a good way to avoid hefty overdraft fees if you overdraw your account frequently. How confident are you in your long term financial plan? When a customer signs up for overdraft protection, they designate a backup account for the bank to use as the source to cover any overdrafts�usually a linked savings account, credit card, or line of credit. Credit Cards Some institutions allow overdrafts to be covered by linking to a credit card. |

| What is the overdraft protection | 899 |

| Bmo doctor loan | Overdraft protection can help you avoid fees if you overdraw your account. When you sign up for overdraft protection, your bank will use a linked backup source that you designate�a savings account, credit card, or line of credit�to pay for transactions whenever the checking account lacks the needed funds. There are a variety of pros and cons to using overdraft protection, but one thing to bear in mind is that banks aren't providing the service out of the goodness of their hearts. An overdraft fee or overdraft protection only applies to one-time debit and ATM transactions. Fifth Third Bank. Often, the interest on the loan is lower than the interest on credit cards, making the overdraft a better short-term option in an emergency. He applies the lessons he's learned from that financial balancing act to offer practical advice for personal spending decisions. |

22930 s western ave torrance ca 90501

Learn more about this low. A line of credit to to move among menu items.

bmo stadium outside

What is Overdraft Protection?Overdraft protection is a bank-provided service that helps you avoid declined transactions or overdraft fees. Here's how it works. With overdraft protection, checks and other debit transactions still clear when there are insufficient funds, but this service comes at a price. An overdraft limit is the maximum amount your account can be overdrawn. You can apply for an amount between $ and $5,